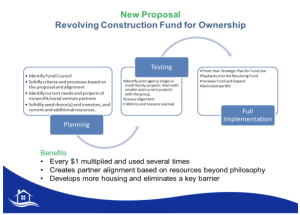

New Proposal: Revolving Construction Fund for Affordable and Workforce Homeownership

Problem and One Solution

According to the Bureau of Labor Statistics (BLS) Consumer Price Index, construction prices inflated 19.6% over the four years. Nonprofit and social venture affordable and attainable housing developers face significant challenges that many in the construction and housing industry avoid through profits. Nonprofit affordable and workforce housing developers do not receive breaks on construction costs, infrastructure, or project design and engineering phases. However, they must sell and rent properties based on the income of low—to moderate-income residents and return those proceeds to the mission of affordable housing. This creates a barrier to sustainable efforts in affordable and workforce housing development, making the need for our proposed fund all the more urgent and necessary.

A revolving construction fund that aligns nonprofit and social venture partners could be a game-changer, offering longer-term sustainability and more impactful public and private investment. If this fund were revolving, meaning organizations would pay it back through proceeds over shorter periods, the public and private investment would support multiple projects for years with each one-time investment (see Graph 1).

The proposed solution is a revolving fund to construct single-family and some multi-family developments. This fund is specifically designed to benefit low to moderate-income households, ranging from 30 to 80 percent area median income (AMI) for affordable housing and up to 110 percent AMI for workforce housing. By covering a broader range of lower incomes, this fund helps mitigate some competition between those looking for affordable homes near job centers, economic development, and families.

Description

The Revolving Construction Fund is a 0-3 percent interest program for WeBuild Concord, other nonprofits, or social venture partners building affordable housing for ownership. It serves as gap funding for affordable developments with short-term turnarounds or completion dates. The fund’s primary goal is to provide short-term capital for construction projects that support low to moderate-income homeownership, community development, and access to wealth creation and neighborhood stability. Doing so directly contributes to the mission of affordable housing, ensuring its sustainability and impact.

WeBuild Concord will administer the fund through a local bank in Cabarrus County in a money market account. Because this is a revolving fund, we will monitor and approve requests for the loan amount, the repayment timeline, and the viability of the single-family, multi-family, or mixed-use project. We will base timeline needs and staggered repayment cycles on 3-month, 6-month, 9-month, and 12-month increments. This will allow loans to revolve through the fund to support approved projects.

A revolving fund council will support and align partners and projects. This ensures input and collaboration.

Revolving Fund Council

A council of local nonprofit affordable and workforce housing developers and private and public sector participants will meet quarterly to review plans with nonprofit housing developers to determine timelines on projects submitted for affordable ownership. This entity will support alignment between nonprofits with shared outcomes for ownership and the stabilization of neighborhoods.

Benefits

Because this is a revolving fund with partners’ input, it offers significant benefits to residents, public and private donors, and investors.

- Every dollar is leveraged or multiplied across several projects for several years.

- Beneficial for one-time and continuous donations and investments for affordable and workforce housing.

- It eliminates some barriers to affordable housing and workforce development in the nonprofit and public community.

- It provides working families with more options for ownership by eliminating some construction costs.

- As necessary, it forces positive alignment between nonprofit affordable and workforce housing developers with shared goals toward the problem.

Request – $2 – 5 million

A $2 – 5 million seed investment from public and private sources will support efforts across its region and serve as a new national affordable and workforce housing model.

We will use this fund to leverage other donors and investments from private foundations, local public entities, and corporations. Because this fund is revolving, it will not diminish. Over time, an accumulation of more funding will allow us to address more significant projects and rental needs in the future.

Again, because the Revolving Fund Council includes nonprofits in the affordable and workforce housing industry, positive alignment and sharing of resources will be a byproduct of this program.